Dotty About Dots

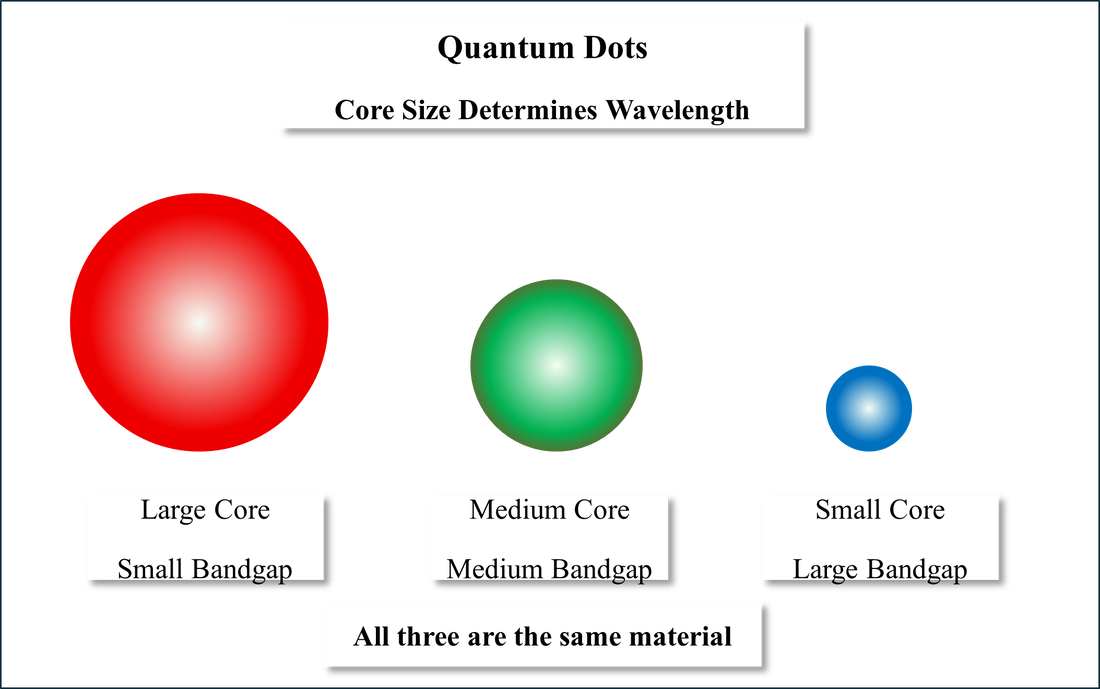

These displays do not have a backlight, nor do they use OLED materials. They are exclusively based on the direct electrical (not optical) stimulation of quantum dots (EL-QD), similar to the way RGB OLED displays are designed. As these QD materials become more efficient and have longer lifetimes, they will move from the ‘demo’ and ‘proof of concept’ stage to practical applications and will compete against both OLED and LCD technology. How long will it take for these materials to mature to the point where EL-QD can be commercialized? It’s a hard question to answer, but based on the progress made to date, we would expect a commercial EL-QD product in 2027. There are still many issues that have to be overcome to reach that stage but over the last year or so we have seen a number of developments that indicate such an expectation is not out of the realm of possibility, and the acquisition of Nanosys (pvt), the leader in the development of QD materials, and Shoei Chemical (pvt), late in 2023 seems to have accelerated QD development for displays.

It will not be an easy competition when it occurs, as there are a number of contenders who have a more mature ecosystem, but at a point down the road, we expect the functional cost of using EL-QDs will become attractive to display producers. Shoei has significant current capacity and the ability to increase that capacity easily when necessary, so while EL-QD has been more the focus for R&D rather than commercial products to date, the fact that QDs are used in many LCD TVs and some OLED TVs gives them a production lead over other potential display technologies. Of course there are issues, with some of the same ‘blue’ difficulties that still face the OLED industry also present with QDs, but we believe that the momentum behind EL-QD is increasing, giving out 2027 commercialization estimate a more realistic shot. Not that far off…

RSS Feed

RSS Feed